Law Enforcement Guide Motor Fuel Use Tax License and Decals

What is the International Fuel Tax Agreement (“IFTA”)?

IFTA is a multijurisdictional agreement between the 48 contiguous States and the 10 Canadian Provinces bordering the United States. The purpose of this Agreement is to enable the participating jurisdictions to act cooperatively and provide mutual assistance in the administration and collection of motor fuel use taxes. Int’l Fuel Tax Agreement, Art. I, effective date Jan. 1, 2025 [hereinafter IFTA]. Illinois is a member jurisdiction to this Agreement. 35 ILCS 505/14a. Illinois administers IFTA through the Motor Fuel Tax Law, 35 ILCS 505/13a-13a.6, and its administrative rules, 86 Ill. Adm. Code 500.300 et seq.

Who must obtain an IFTA license?

Any person (individual, corporation, partnership, association, trust, or other entity) based in a member jurisdiction operating a qualified motor vehicle(s) in two or more member jurisdictions is required to obtain a license under this Agreement, except as indicated in IFTA Articles of Agreement Sections R310 and R500. IFTA, Art. II, sec. R242 and Art. III, sec. R305.

Which vehicles must have IFTA decals?

Qualified motor vehicles operating in two or more jurisdictions must have decals placed on the exterior portion of both sides of the cab. IFTA, Art. VI, sec. R625.

What are “qualified motor vehicles”?

“Qualified motor vehicles” are vehicles used, designed, or maintained for transporting persons or property and either:

• having two axles and a gross vehicle weight or registered gross weight exceeding 26,000 pounds or 11,793 kilograms;

• having three or more axles regardless of weight; or,

• used in combination and the gross weight or the registered gross weight of the combined vehicles exceeds 26,000 pounds or 11,793 kilograms. IFTA, Art. II, sec. 245.

Under Illinois’ Motor Fuel Tax Law, commercial motor vehicles are qualified motor vehicles and are defined in 35 ILCS 505/1.16.

What are Illinois’ motor fuel use tax license and decal requirements?

All qualified/commercial motor vehicles traveling in or through Illinois must display either:

• an IFTA license and decals from any IFTA member jurisdiction, or

• an Illinois single-trip permit (no decals). Illinois single-trip permits are valid for 96 hours.

A valid license or permit must be carried in the cab of each qualified/commercial motor vehicle. Valid decals must be displayed on the exterior portion of the vehicle’s cab - one decal on each side. 86 Ill. Adm. Code 500.310, 320.

Which motor vehicles are exempt in Illinois?

The following qualified motor vehicles are exempt from registering for the motor fuel use tax in Illinois:

• recreational vehicles registered as recreational vehicles,

• school buses (must have school bus license plates),

• state of Illinois or federal vehicles, and

• qualified/commercial motor vehicles operating solely within Illinois for which all motor fuel is purchased within Illinois. 35 ILCS 505/1.16; 86 Ill. Adm. Code 500.300(d); IFTA, Art. II, sec. R245 and R249.

When must qualified motor vehicles display decals?

Qualified/commercial motor vehicles are required to display motor fuel use tax decals within these guidelines:

• Current-year decals are valid from January 1 through December 31.

• Next-year decals may be displayed beginning November 1 of the current year.

• Current-year decals must be displayed by March 1 of the current year.

86 Ill. Adm. Code 500.310(f).

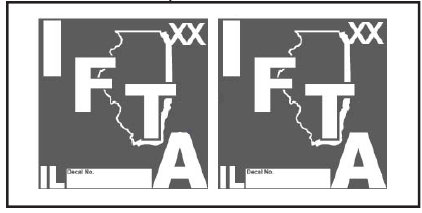

What do the Illinois IFTA motor fuel use tax decals look like

Below are examples of the decals issued to Illinois-based carriers for qualified/commercial motor vehicle.

All valid U.S. or Canadian IFTA member license and decals are honored by Illinois. 86 Ill. Adm. Code 500.310(f). Example: IFTA license and decals issued by Wisconsin are acceptable in Illinois. If a valid U.S. or Canadian IFTA member license and decals are not displayed, see the single-trip permit section on the following page. All valid U.S. or Canadian IFTA member license and decals are honored by Illinois. 86 Ill. Adm. Code 500.310(f). Example: IFTA license and decals issued by Wisconsin are acceptable in Illinois.

If a valid U.S. or Canadian IFTA member license and decals are not displayed, see the single-trip permit section below.

What if a qualified motor vehicle is operating with a revoked license?

When a qualified/commercial motor vehicle is found operating in Illinois under a revoked motor fuel use tax license, the motor vehicle shall be placed out of service and not be allowed to operate in Illinois until the license is reinstated. 35 ILCS 505/13a.6(a).

Violations

Failure to display:

- Motor Fuel Use Tax license — 625 ILCS 5/11-1419.02

- Motor Fuel Use Tax decals — 625 ILCS 5/11-1419.03

- Operating with a revoked Motor Fuel Use Tax license — 625 ILCS 5/11-1419.05 and

- Operating without a single-trip permit — 625 ILCS 5/11-1419.01

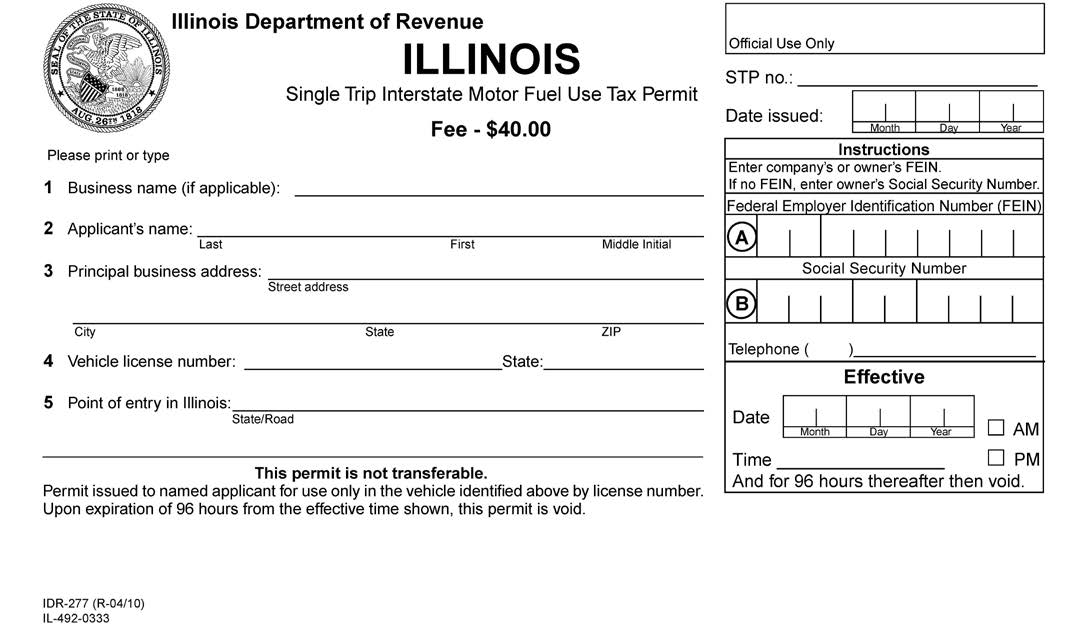

What does the Illinois single-trip permit look like?

An example of the Illinois single-trip permit is provided.

Any person operating a qualified/commercial motor vehicle in Illinois in the course of interstate traffic, who does not have a valid IFTA license and decals, must have a valid Illinois single-trip permit for interstate motor fuel use tax in possession. 35 ILCS 505/13a.5.

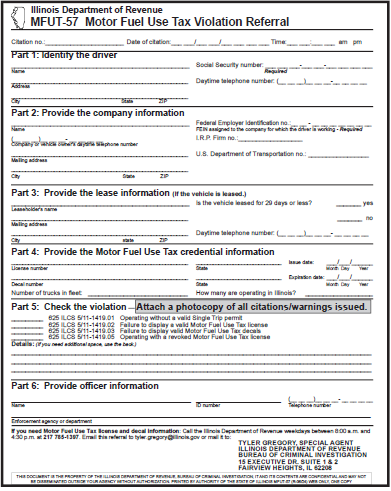

What must I do if I write a traffic citation for operating without, or failing to display, motor fuel use tax credentials?

When you write a traffic citation, you must also complete Form MFUT-57, Motor Fuel Use Tax Violation Referral. An example is provided.

Attach a photocopy of the citation to the completed referral and mail them to the address at the bottom of the referral. Please contact our Bureau of Criminal Investigations weekdays between 8:30 a.m. and 5:00 p.m. at: 217 785-8200 if you need a new supply of referral forms.

p.m. at: 217 785-8200 if you need a new supply of referral forms.

Questions?

For more information, visit our web site at tax.illinois.gov.

If you have questions about a motor fuel use tax account, contact our Motor Fuel Use Tax Section weekdays between 8:00 a.m. and 4:00 p.m. at: 217 785-1397 or by email at REV.IFTA@illinois.gov.

Or write us at: MOTOR FUEL USE TAX SECTION

ILLINOIS DEPARTMENT OF REVENUE

PO BOX 19467

SPRINGFIELD IL 62794-9467

If you have questions about license, permit, and decal violations, you may call our Bureau of Criminal Investigations weekdays between 8:30 a.m. and 5:00 p.m. at: 217 785-8200.

PIO-20 (R-05/25)