Local Governments' Guide to Tax Allocations

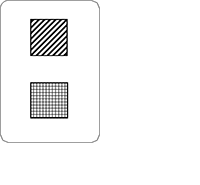

Sales Tax Collection Cycle

Indicates editing of the return and division of the tax money paid into the proper amounts due to the state and local taxing authorities.

Indicates editing of the return and division of the tax money paid into the proper amounts due to the state and local taxing authorities.

Indicates the various processing functions of opening mail, depositing money, data entry of return information, and review of reports prior to allocations.

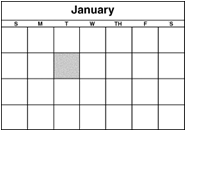

Any day during January, John goes to the hardware store to buy a gallon of paint. The store collects John’s payment, including the sales tax due based on the location of the sale (in this case, the store’s location).

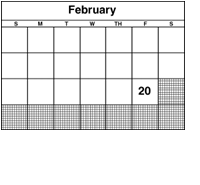

On February 20, the hardware store files its January Form ST-1, Sales and Use Tax and E911 Surcharge Return, paying all sales taxes collected during January. This payment includes the tax paid on the gallon of paint purchased by John. Upon receipt of the return and payment, the Illinois Department of Revenue (IDOR) deposits this money into the appropriate funds using a percentage formula. Approximately 100,000 ST-1 returns are received and processed each month.

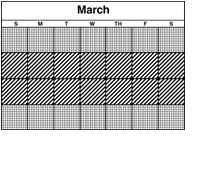

In March, we enter the information from the return into the computer. The return is edited for accuracy, and the tax is divided into the proper amounts due to the state, municipality, county, or other local taxing districts according to the location of the sale. The Local Tax Allocation Division reviews preliminary reports prior to authorizing distribution.

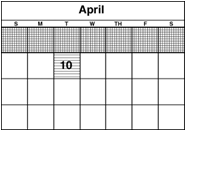

During the first part of April, IDOR authorizes the Comptroller’s office to issue a warrant to the municipality, county, or other local taxing district. Around the tenth of the month, a warrant will be issued.

PTAX-1002-10 (R-11/04) Printed by authority of the State of Illinois - Web only, One copy