Destination-Based Sales Tax Assistance

This webpage is intended as a guide for Remote Retailers, Marketplace Facilitators, and, beginning January 1, 2025, Retailers Maintaining a Place of Business in this State*making sales from outside of this State to Illinois customers who must collect and remit "destination-based" Retailers’ Occupation Tax (sales tax). This webpage does not pertain to sales subject to “origin-based” sales tax.

Note: Effective January 1, 2025, retailers previously obligated to collect and remit Illinois Use Tax (UT) on retail sales sourced outside of Illinois and made to Illinois customers are subject to destination-based sales tax (Public Act 103-983). Also effective January 1, 2025, lease transactions are subject to Illinois Sales and Use Tax (Public Act 103-592).

Effective January 1, 2026, the 200-transaction threshold for requiring remote retailers and marketplace facilitators to collect and pay destination-based sales tax will be removed. Beginning January 1, 2026, for sales subject to "destination-based" sales tax, if a taxpayer fails to provide sufficient information to determine the proper location, IDOR will assess tax on the gross receipts of such sales to undetermined tax locations at the rate of 15%. Refer to Public Act 104-0006 and FY 2026-12, Destination-Based Retailers' Occupation Tax Changes, for additional information.

Destination-based sales tax rate means the total State and local retailers' occupation tax rate calculated for a sale using the rate in effect at the Illinois location to which the tangible personal property is shipped or delivered or at which possession is taken by the purchaser. [35 ILCS 120/2-12]

- Remote retailers without a physical presence in this State, and marketplace facilitators (for all marketplace sellers' sales and marketplace facilitators’ own sales through the marketplace that are sourced outside of this State), must collect Retailers' Occupation Tax (ROT) at the destination-based sales tax rate if they meet the tax remittance threshold for sales into Illinois. For more information on Destination-based sales tax, see the Out-of-State Sales Resource Page.

- Beginning January 1, 2026, a retailer must determine if it meets the threshold of $100,000 or more in cumulative gross receipts from sales of tangible personal property to purchasers in Illinois by determining on a quarterly basis, ending on the last day of March, June, September, and December, whether it meets or exceeds the tax remittance threshold for the preceding 12-month period.

- Beginning January 1, 2021, a remote retailer is considered a retailer engaged in the occupation of selling tangible personal property at retail in Illinois and is subject to State and local ROT if either of the following tax remittance thresholds is met:

- $100,000 or more in cumulative gross receipts from sales of tangible personal property to purchasers in Illinois; or

- 200 or more separate transactions for the sale of tangible personal property to purchasers in Illinois (applicable through December 31, 2025).

For more information on the lookback period and tax remittance thresholds for sales into Illinois, see 86 Ill. Adm. Code 131.115, 86 Ill. Adm. Code 131.135, and Public Act 104-0006.

For information on determining where a retail sale is sourced, see 86 Ill. Adm. Code 270.115 and PIO-125, Determining Physical Presence and Where a Sale is Sourced – Sales and Use Tax Help Guide.

Use the following steps to aid in

- determining your tax rate and local government location code,

- adding changing location tax sites to your ST-1 account through your MyTax Illinois logon, and

- filing your Form ST-1/ ST-2.

Determining Your Tax Rate and the Location Code for a destination-based sale made to an Illinois purchaser -- Instructions for using MyTax Illinois Tax Rate Finder

To calculate the correct tax to collect and to determine the Location Code for your sale to an Illinois purchaser, use the "Search by Address" function of our MyTax Illinois Tax Rate Finder found on our website, mytax.illinois.gov.

- Enter the address of your purchaser or the destination of the sale.

- Validate address to ensure the 9-digit zip code is properly displayed.

- Select "Conduct Inquiry".

- Note the appropriate sales tax rates for the address where the taxable sale will be delivered or where possession will be taken (destination). This tax rate will be entered on the ST-2 Multiple Site Form. Multiple sales made to the same location code with the same tax rate will be entered as a single aggregate entry on the ST-2.

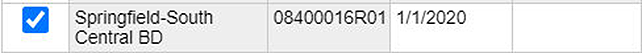

- Note the appropriate Location Code for the address where the taxable sale will be delivered or where possession will be taken (destination). The location code will have 11 characters (xxxxxxxxRxx). For example, the Springfield South Central Business District will have a location code of 08400016R01.

- Do not use your Illinois customer’s address as the tax site location; instead, use the Location code for the corresponding "Local Government" taxing district when adding a location to your account and when reporting the location on the ST-2 Multiple Site Form.

Note: Once the location code has already been added to your registration, you do not need to add it again. - Repeat steps 1-5 for each sale (location) to be reported.

Add the location code to your MyTax Illinois sales tax account

In order to file and pay sales tax correctly and without processing delays, each location in the State of Illinois to which you make sales must be added to your account.

Important note: The Illinois Department of Revenue (IDOR) has updated MyTax Illinois to simplify filing for remote retailers and marketplace facilitators using Form ST-1, Sales and Use Tax and E911 Surcharge Return. These users are no longer required to add or remove changing locations before filing; all changing locations are available on one screen when the user files Form ST-1 and Form ST-2 using MyTax Illinois.

Users can enter sales receipts, with previously registered locations shown at the top of the screen, for the applicable reporting period. Once all receipts are entered for the reporting period, the user can select “Next” to view a summary of Form ST-2, Multiple Site Form. Figures from the summary page cannot be changed without returning to the prior page. These figures will be calculated and populated on the applicable Form ST-1 lines.

Changing locations can also be added individually at any time using the “Maintain Locations” option on MyTax Illinois. See below for step-by-step instructions on adding a changing location using the “Maintain Locations” link. Permanent locations will continue to be added using the “Maintain Locations” option for all taxpayers filing Form ST-1 through MyTax Illinois.

- Log in to your MyTax Illinois account using your existing logon information.

- If you do not have a MyTax Illinois logon, visit mytax.Illinois.gov to create a MyTax Illinois logon, call Central Registration at 217 785-3707, or email rev.crd@illinois.gov.

- If you need to change your registration from a Use Tax account to a destination-based sales tax account contact Central Registration at 217 785-3707 or rev.crd@illinois.gov for assistance.

- Select "View more account options" on your sales tax account.

- Under the panel "Account Maintenance," select "Maintain Locations".

- Select "next", and then "next" again to add the changing location tax site for the Local Government Location Code that corresponds to the customer’s address for your sale. (Locations used for destination-based sales tax are not entered by a permanent address in your account.)

NOTE: If you are a retailer with a brick-and-mortar location in Illinois from which sales are made, you should register the physical brick-and-mortar address as your permanent location tax site. See “How do retailers use MyTax Illinois to maintain site locations for their sales tax accounts?” for more information on adding a permanent location using MyTax Illinois.

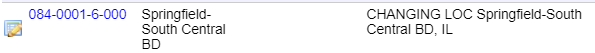

- Check the appropriate location(s) for your sale(s) and enter the start date for each location. You should enter all locations in which you made sales before submitting. Ensure the location code and local government name match the information from the Tax Rate Finder.

NOTES: There are two separate tables on the "Add Changing Locations Sites" tab labeled "Municipalities" and "Counties".

- The location code for most addresses in the state will be listed in the "Municipality" table.

- If the "Local Government" name listed on the Tax Rate Finder has the word "County" in it, use the 'county' table to find the location.

- All others will use the 'Municipalities' table.

- You may filter through locations by using the filter line on either table. Enter the "Location code" or the "Local Government" name from the Tax Rate Finder to narrow the search.

- Some municipalities will have more than one taxing jurisdiction (business districts, mass transit districts, or multi-county municipalities), be sure to use the Location Code provided in the tax rate finder corresponding to the Local Government for the address of your sale.

- If you have previously added a location, it will not show as available to add again.

- Once you have added the location to your sales tax account registration, you will not need to add it again for subsequent sales.

Information on location codes

Note: This section is intended to provide information on location codes that may be helpful for third-party software vendors and the retailers utilizing these programs to file their returns.

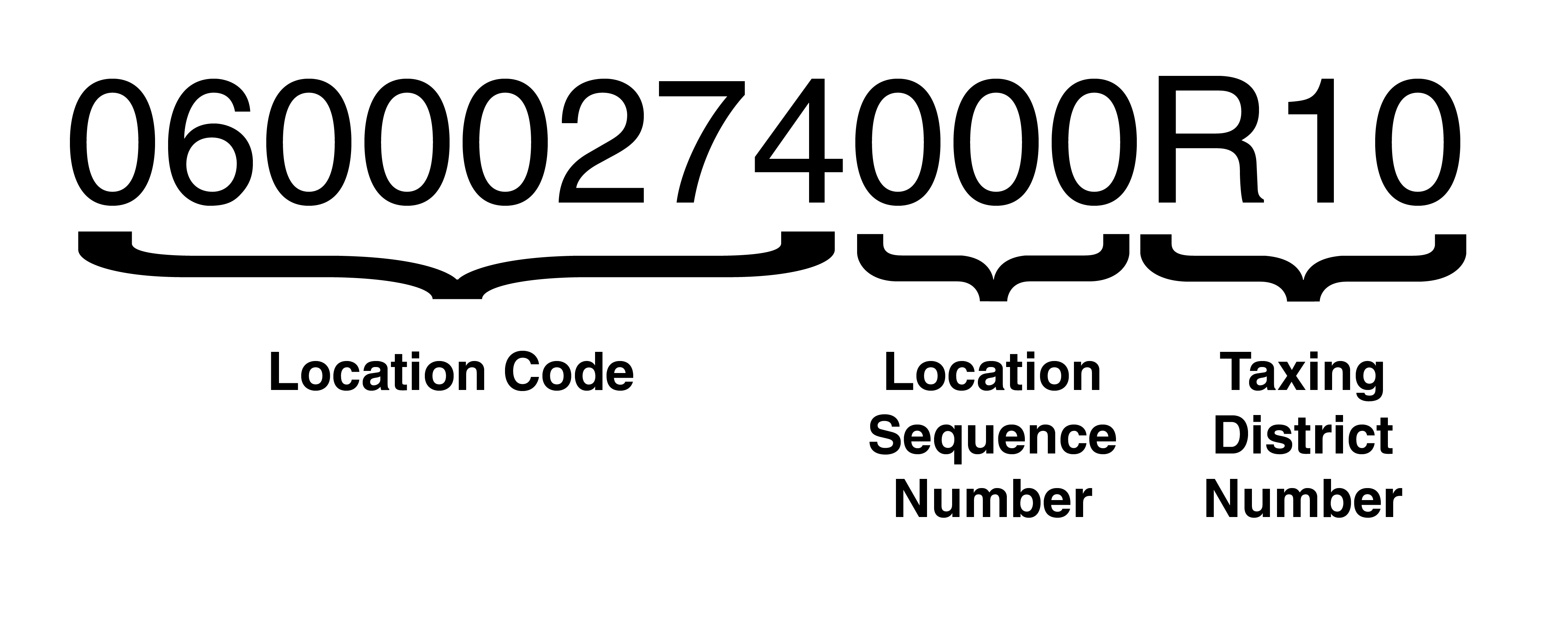

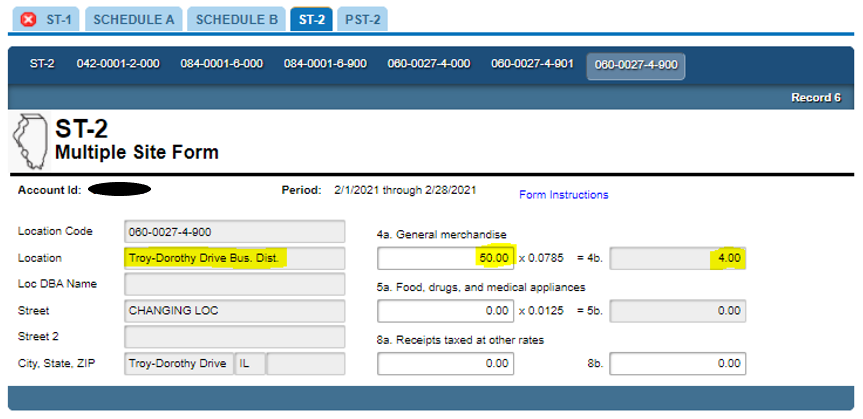

Above is an example of a complete location code which includes the "abbreviated" location code, the location sequence number, and taxing district number.

The 11-character location code that is listed on the Tax Rate Finder consists of the 8-digit "abbreviated" location code and the taxing district number (for the example above the Tax Rate Finder would have returned 06000274R10 listed as Troy (MED)).

The first eight (8) numbers of the above code represents the "abbreviated" location code. This number may be the same for multiple taxing jurisdictions around the same area.

- EXAMPLE: The above number is for the Troy (MED) location. The same beginning eight number code will be used for the five other taxing jurisdictions in the Troy area as well. These include the Troy location outside of the MED or any of the four business districts in Troy.

The last three numbers in the above code represent the taxing district number and distinguishes one of the taxing locations in an area from another.

- EXAMPLE: The Troy (MED) location has a taxing district number of R10. As stated earlier, Troy (MED) shows up in the Tax Rate Finder as 06000274R10. The Troy-Dorothy Drive Business District shows up in the Tax Rate Finder as 06000274R01 while the Troy Business District IV shows up as 06000274R04.

The taxing district number must be included with all return submissions.

Once a location has been added to your account, IDOR's system will assign that location a location sequence number based on how many locations with the same 8-digit "abbreviated" location code have been added. The first location sequence number assigned when adding a changing location is '000', the second location with the same "abbreviated" location code is assigned '900', the third is assigned '901', the fourth is assigned '902', etc.

- EXAMPLE: If you add the Troy (MED) area to your account as a changing location before adding any other '06000274' "abbreviated" location code, it will be assigned the '000' location sequence code. In other words, it will now show up in MyTax Illinois as 06000274000. If you add the Troy-Dorothy Drive Business District next, it will be assigned a location sequence code of '900' (because it is the second 06000274 "abbreviated" location code to be added) and show up in MyTax Illinois as 06000274900. If the third 06000274 "abbreviated" location code you add is for the Troy Business District IV, it will show up in MyTax Illinois as 06000274901. NOTE: Once the specific location has been added to your account, the taxing district number is no longer displayed in MyTax Illinois.

Electronic filing methods

IDOR has two ways to file a return electronically.

- MyTax Illinois--MyTax Illinois is a free online account management program that offers a centralized location for businesses to register for taxes, file returns, make payments, and manage their tax accounts. NOTE: Participants using our free MyTax Illinois program should not complete the Business Electronic Filing Enrollment Application unless they plan to use the Illinois Electronic Filing Program in addition to the MyTax Illinois Program.

- Direct (Electronic) File--IDOR has the ability to electronically receive and process certain return types from software developers, transmitters, Electronic Return Originators (EROs), and taxpayers. Participants must be enrolled and follow IDOR's guidelines. To enroll, complete the Business Electronic Filing Enrollment Application located on MyDevPortal. For more information, visit IDOR's Electronic Filing Program for Sales & Use Tax Returns page.

NOTE: Illinois filers are not restricted to using only one method for filing and remitting. They may use either of the above electronic methods for filing their return and another of IDOR's payment methods for remitting their taxes.

Filing for the period

All sales from a period are reported on Form ST-1, Sales and Use Tax and E911 Surcharge Return, which is due on the 20th of the month following the close of the reporting period. Form ST-2, Multiple Site Form, is used to report sales and tax collected by location code.

For MyTax Illinois Filers – MyTax Illinois has many automated features to help complete your sales tax return faster and easier. Please note that, in order for the automated features to work properly, you must register all locations at which you make sales. For remote retailers and marketplace facilitators adding a changing location, the new return screen mentioned in the “Add the location code to your MyTax Illinois sales tax account” section above may be utilized. For remote retailers and marketplace facilitators adding a permanent location, the “Maintain Locations” option will be used.

In MyTax Illinois:

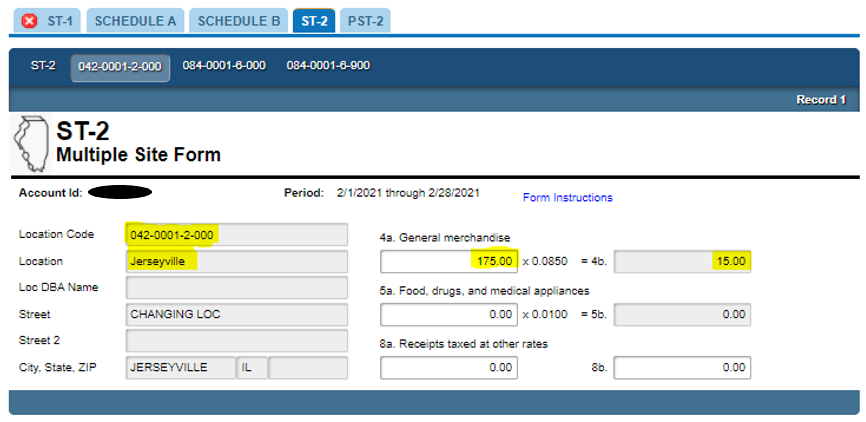

- While filing your ST-1 return, select the ST-2 tab at the top of the form to report taxable sales made to each location. After selecting the ST-2 tab, users can access the desired location by clicking on the location code next to the appropriate location name from the list of locations.

- Enter the amount of taxable transactions for each location. Multiple sales made to the same location code with the same tax rate will be entered as a single combined entry on the ST-2.

- Tax rates will automatically be populated on the ST-2 based on the location that was selected.

- Tax due will be systematically calculated using your general merchandise sales (4a) and/or food, drug and medical appliances (5a) and carried to the ST-1.

- Complete the ST-1. See the Form ST-1 Instructions for more information.

MyTax Illinois examples for reporting sales on the ST-2

Example 1 --

The Basket Place is a registered remote retailer which reports sales of gift baskets to three different addresses in Jerseyville.

1st transaction: $50

2nd transaction: $25

3rd transaction: $100

The Tax Rate Finder returns the same location code for all three addresses. The location code is 04200012R00 with a tax rate of 8.500%. The transactions in this example are reported on the same ST-2 tab, therefore only one location must be added through MyTax using the appropriate location code (04200012R00) and location name (Jerseyville). The taxable transactions ($50 + $25 + $100) will be totaled (total of $175) and entered as a single entry on line 4a of the ST-2 tab for location 04200012R00. The tax is systematically calculated for the taxable sales on line 4b.

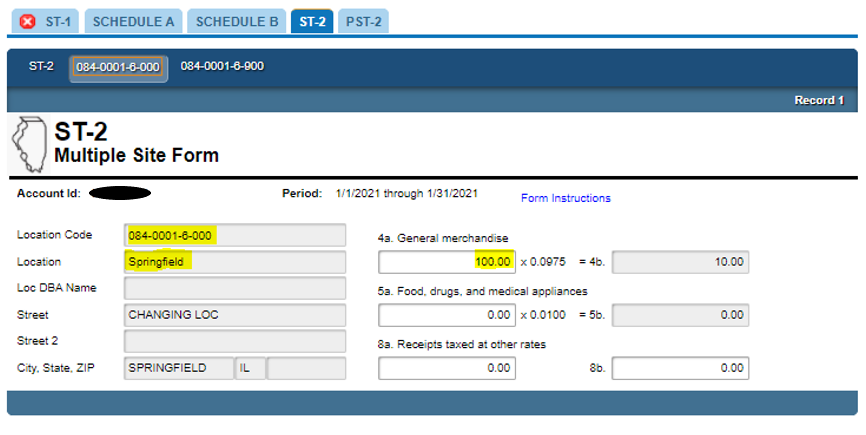

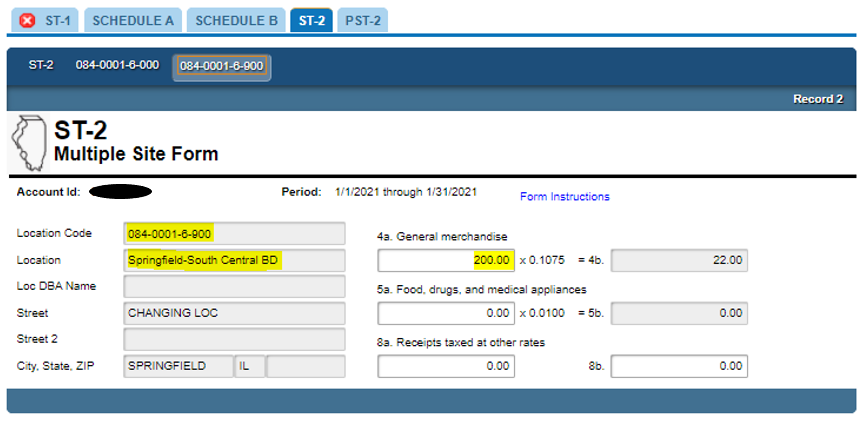

Example 2 --

Klothes for Kittens is a registered remote retailer which reports sales to two addresses in Springfield.

1st transaction: $100 sale of rain boots for cats to John Smith

2nd transaction: $200 sale of collars for cats to Ms. Jones

For the first transaction, the Tax Rate Finder returns a location code of 08400016R00 and a tax rate of 9.75%. For the second transaction, the Tax Rate Finder returns a location code of 08400016R02 with a Springfield-South Central business district 2 tax rate of 10.75%. The transactions in this example are reported on separate ST-2 tabs, therefore both locations must be added through MyTax using the appropriate location codes and location names. The amounts are entered on line 4a of their respective ST-2 tabs. The tax is systematically calculated for the taxable sales on line 4b.

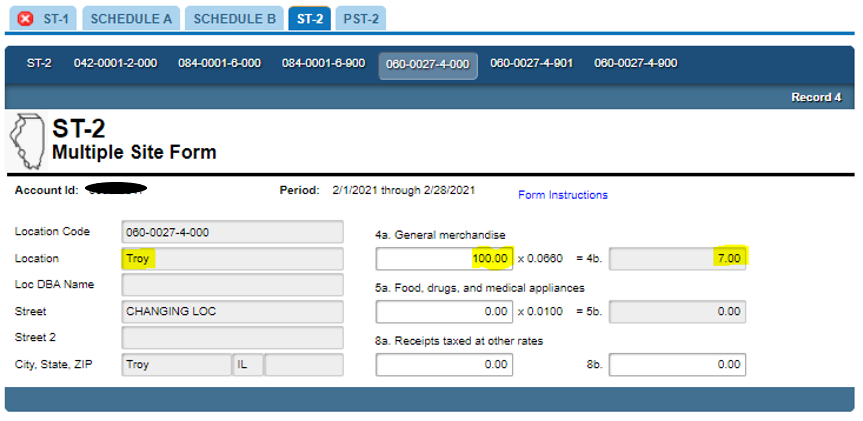

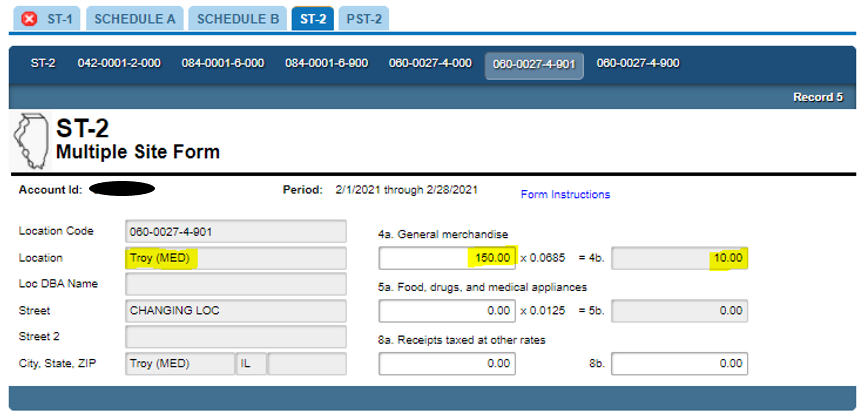

Example 3 --

The Spicy Owl is a registered remote retailer which reports separate sales of spice grinders to multiple restaurants in Troy.

1st transaction: $100 sale to a restaurant address in Troy

2nd transaction: $150 sale to a restaurant address in Troy (MED)

3rd transaction: $50 sale to a restaurant address in Troy-Dorothy Drive Business District

For the first transaction ($100), the Tax Rate Finder returns a location code of 06000274R00 and a tax rate of 6.60%. For the second transaction ($150), the Tax Rate Finder returns a location code of 06000274R10 and a tax rate of 6.85%. For the third transaction ($50), the Tax Rate Finder returns a location code of 06000274R01 and a tax rate of 7.85%. The Spicy Owl appropriately used the Tax Rate Finder to add all three changing locations with the appropriate location code and location name. The transactions in this example are reported on separate ST-2 tabs. The amounts are entered on line 4a of their respective ST-2 tabs. The tax is systematically calculated for the taxable sales on line 4b.

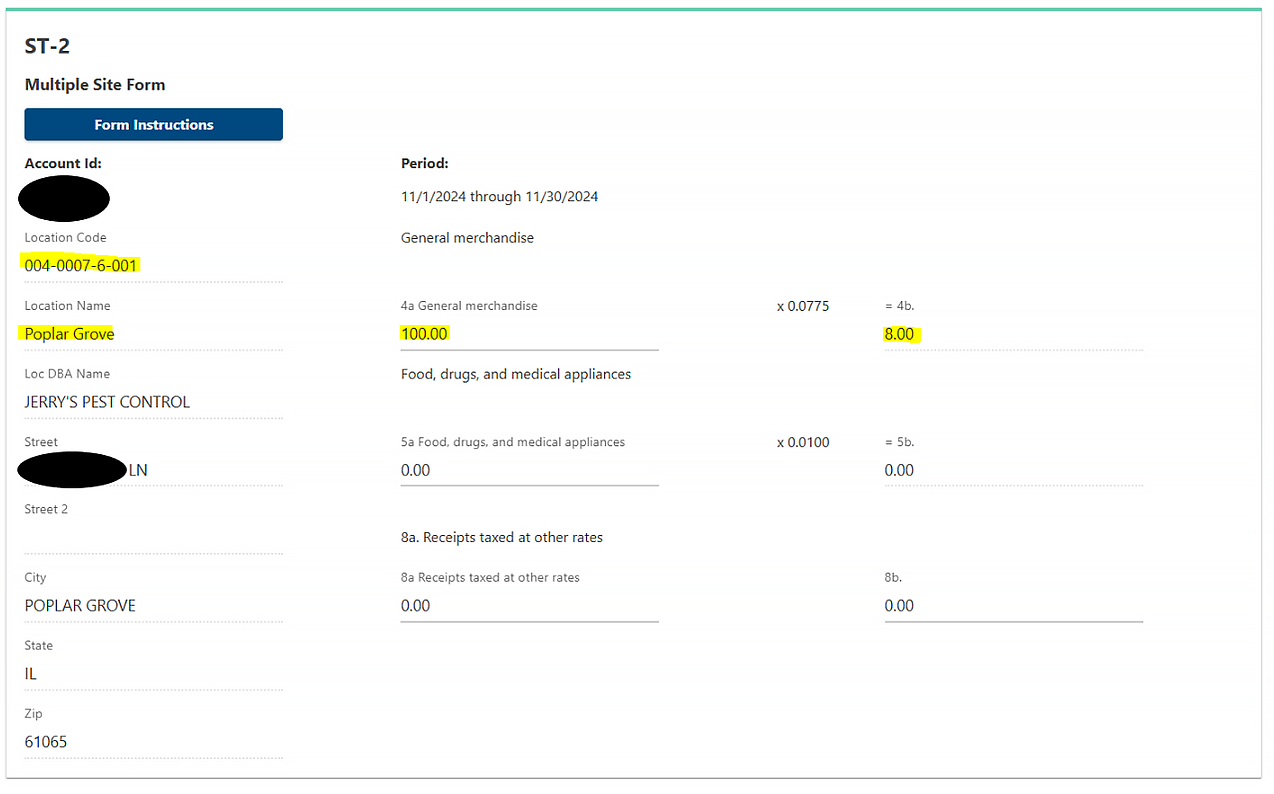

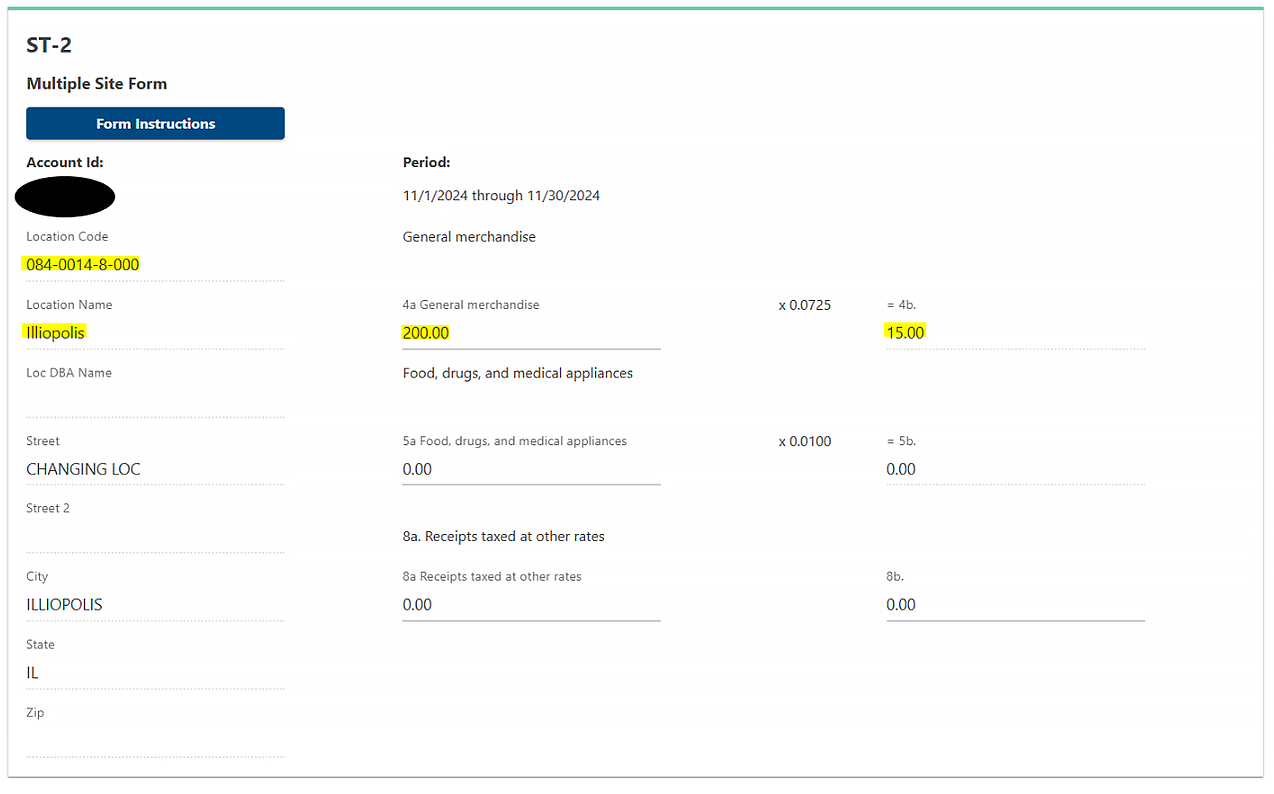

Example 4 --

Jerry’s Pest Control is an in-State retailer which makes sales from a permanent location in Illinois as well as sales fulfilled from an inventory outside of Illinois.

1st transaction: $100 sale from the business’s permanent sale location in Poplar Grove, Illinois

2nd transaction: $200 sale fulfilled from the business’s inventory located outside of Illinois to a customer located in Illiopolis, Illinois (for the purposes of this 2nd transaction, assume the sale would otherwise be sourced outside of Illinois applying the selling activities set out in 86 Ill. Adm. Code 270.115)

For the first transaction, the Tax Rate Finder returns a location code of 00400076R00 and a Poplar Grove tax rate of 7.75%. For the second transaction, the Tax Rate Finder returns a location code of 08400148R00 with an Illiopolis tax rate of 7.25%. The transactions in this example are reported on separate ST-2 tabs, therefore both locations must be added through MyTax using the appropriate location codes and location names. The first location must be registered as a permanent location, and the second location must be registered as a changing location. The amounts are entered on line 4a of their respective ST-2 tabs. The tax is systematically calculated for the taxable sales on line 4b.

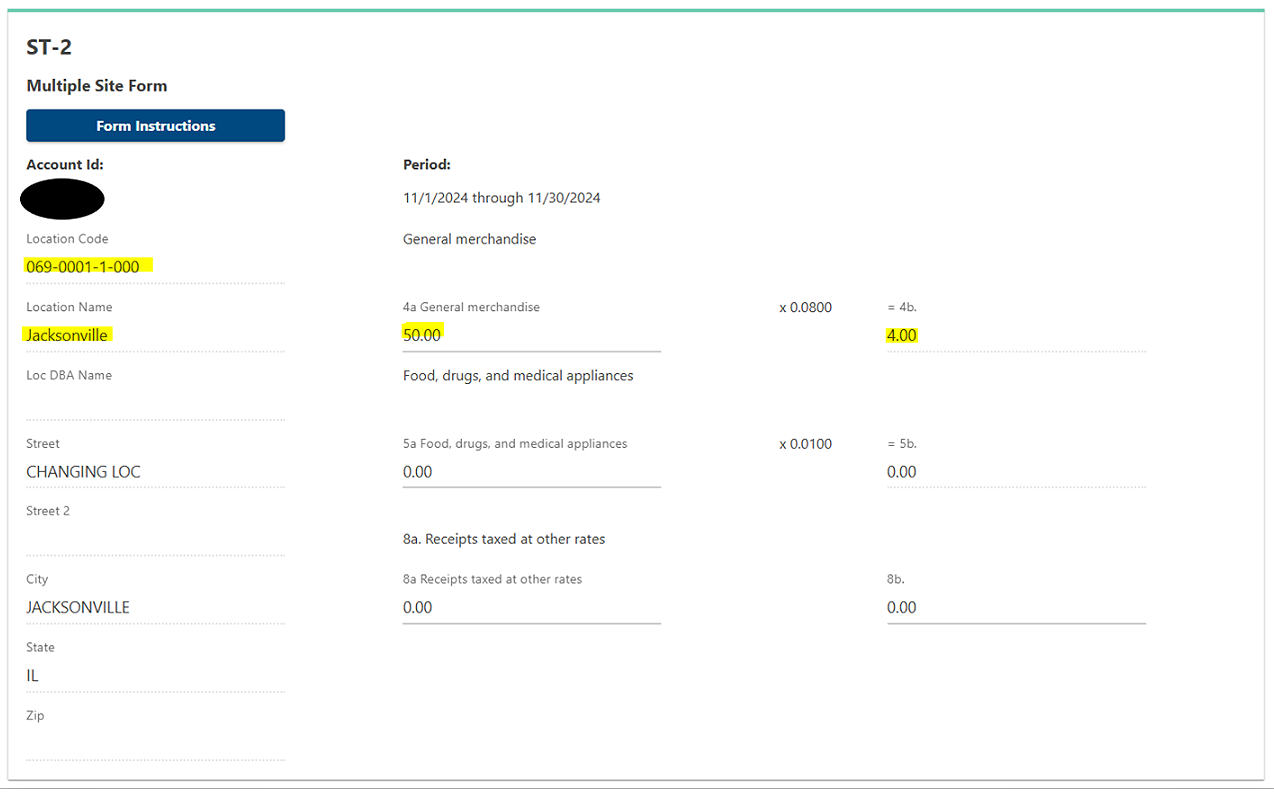

Example 5 --

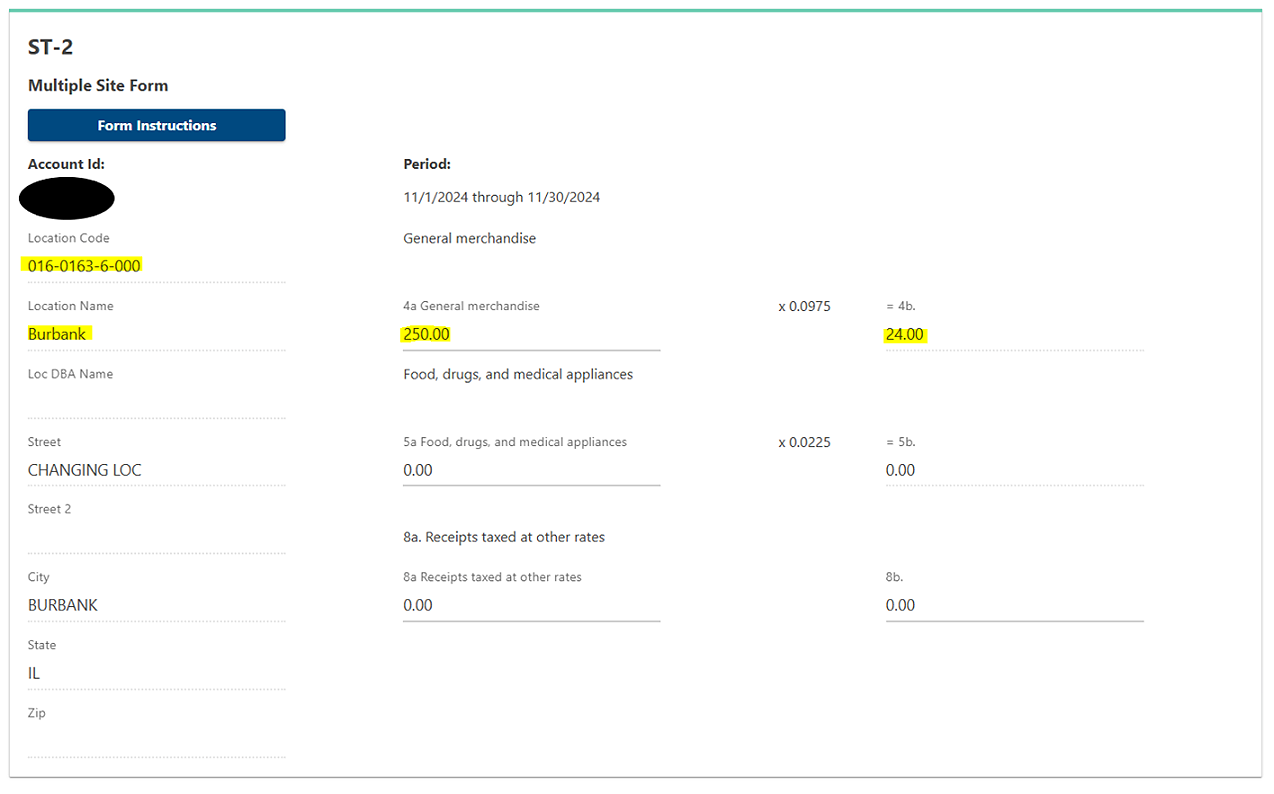

Wit’s End is an out-of-State** retailer which has physical presence in Illinois and makes sales into Illinois to two separate locations. (For the purposes of these transactions, assume the sales would otherwise be sourced outside of Illinois applying the selling activities set out in 86 Ill. Adm. Code 270.115)

1st transaction: $50 sale to a customer in Jacksonville, Illinois

2nd transaction: $250 sale to a customer in Burbank, Illinois

For the first transaction, the Tax Rate Finder returns a location code of 06900011R00 for Jacksonville and a tax rate of 8.00%. For the second transaction, the Tax Rate Finder returns a location code of 01601636R00 for Burbank and a tax rate of 9.75%. The transactions in this example are reported on separate ST-2 tabs, therefore both locations must be added through MyTax using the appropriate location codes and location names. The amounts are entered on line 4a of their respective ST-2 tabs. The tax is systematically calculated for the taxable sales on line 4b.

For Direct File (Electronic) Filers – Taxpayers that use direct file options should frequently visit IDOR's Electronic Filing Program for Sales & Use Tax Returns page for updates. IDOR will post updates to electronic filing information as they become available.

- Direct filers are required to use the complete 14-digit location code for each of their changing locations that have been registered to their account. The complete location code will be the 11 characters as listed in on their MyTax Illinois account plus the taxing district number (Rxx number) found from the machine-readable file or the Tax Rate Finder (see "Information on Location Codes" above for more information). Enter the 14-digit code on the "Location Code" line for each unique location code to which sales were made during the reporting period.

- On Form ST-2, enter the amount of taxable transactions for each location for the reporting period. Multiple sales made to the same location code with the same tax rate will be entered as a single combined entry on the ST-2.

- See the direct file specifications on the Electronic Filing Program for Sales & Use Tax Returns page for more information.

Additional Notes

MyTax will systematically round sales figures appropriately.

For example, $1.49 becomes $1 and $2.50 becomes $3. If you need to add two or more amounts to figure the amount to enter on a line, include cents when adding the amounts and round only the total.

- Remote retailers and retailers maintaining a place of business in this State shall maintain books and records for sales, including all sales made over a marketplace, in accordance with the requirements of Section 7 of the Retailers' Occupation Tax Act (ROTA).

- Additional information for remote retailers, marketplace facilitators, and retailers maintaining a place of business in this State can be found on the IDOR's website at:

* As used in this document, “State” refers to the State of Illinois.

** As used in this document, “out-of-State” refers to outside of the State of Illinois.

Note: The information contained on this page is current as of September 2025.