Form TP-1-IL Instructions

General Instructions

Who must file Form TP-1-IL?

You must file Form TP-1-IL, Uniform Tobacco Transaction Schedule, to report all transactions of tobacco products in a reporting period. Form TP-1-IL consists of multiple schedules. See below for a list of Schedule Codes and descriptions to determine which schedule to use depending on the transaction.

When do I file Form TP-1-IL?

You must file Form TP-1-IL with Form TP-1, Uniform Tobacco Products Tax Return, on or before the 15th day of each month to report transactions, purchases, returns, and sales, you made during the preceding month. All tobacco product distributors are mandated to electronically file Form TP-1. If the due date falls on a weekend or holiday, your return and payment are due the next business day.

If you have no purchases or sales during a month, you must still file a return for that liability period.

What if I need assistance?

If you have questions about this return, email us at REV.ATP-MFR@illinois.gov or call our Springfield office weekdays between 8:00 a.m. and 4:00 p.m. at 217 782-6045.

Definitions

E-cigarettes

Electronic cigarette means:

- Any device that employs a battery or other mechanism to heat a solution or substance to produce a vapor or aerosol intended for inhalation, except for (A) any device designed solely for use with cannabis that contains a statement on the retail packaging that the device is designed solely for use with cannabis and not for use with tobacco or (B) any device that contains a solution or substance that contains cannabis subject to tax under the Compassionate Use of Medical Cannabis Program Act or the Cannabis Regulation and Tax Act;

- Any cartridge or container of a solution or substance intended to be used with or in the device or to refill the device, except for any cartridge or container of a solution or substance that contains cannabis subject to tax under the Compassionate Use of Medical Cannabis Program Act or the Cannabis Regulation and Tax Act; or

- Any solution or substance, whether or not it contains nicotine, intended for use in the device, except for any solution or substance that contains cannabis subject to tax under the Compassionate Use of Medical Cannabis Program Act or the Cannabis Regulation and Tax Act.

- Electronic cigarette includes, but is not limited to, any electronic nicotine delivery system, electronic cigar, electronic cigarillo, electronic pipe, electronic hookah, vape pen, or similar product or device, and any component or part that can be used to build the product or device.

Moist Snuff

Moist snuff means any finely cut, ground, or powdered tobacco that is not intended to be smoked, but shall not include any finely cut, ground, or powdered tobacco that is intended to be placed in the nasal cavity.

Other Tobacco Products (OTP)

For reporting purposes, Other Tobacco Products (OTP) are any products that meet the definition of “Tobacco Products” excluding products that meet the definition of “E-cigarette” or “Moist Snuff”.

Taxable Products

Sales of tobacco products, excluding little cigars, by distributors who will not sell the product to a retailer or consumer are not subject to the tax imposed by the Tobacco Products Tax Act of 1995 (the Act). Sales by a distributor to another distributor as sales for resale are not subject to the tax imposed by the Act. Sales of tobacco products to retailers or consumers are taxable sales. See 86 Ill. Adm Code 660.5 and 660.30.

Tobacco Products

Tobacco products means any product that is made from or derived from tobacco that is intended for human consumption or is likely to be consumed, including but not limited to cigars, including little cigars; cheroots; stogies; periques; granulated, plug cut, crimp cut, ready rubbed, and other smoking tobacco; snuff (including moist snuff) and snuff flour; cavendish; plug and twist tobacco; fine-cut and other chewing tobaccos; shorts; refuse scraps, clippings, cuttings, and sweeping of tobacco; snus; shisha and tobacco for use in waterpipes; and other kinds and forms of tobacco, prepared in such manner as to be suitable for chewing or smoking in a pipe or otherwise, or both for chewing and smoking for inhalation, absorption, or ingesting by any other means; but does not include cigarettes as defined in Section 1 of the Cigarette Tax Act or tobacco purchased for the manufacture of cigarettes by cigarette distributors and manufacturers defined in the Cigarette Tax Act and persons who make, manufacture, or fabricate cigarettes as a part of a Correctional Industries program for sale to residents incarcerated in penal institutions or resident patients of a State operated mental health facility.

Beginning July 1, 2025, “tobacco products” also includes any product that is made from or derived from tobacco, or that contains nicotine whether natural or synthetic, that is intended for human consumption or is likely to be consumed, including but not limited to nicotine pouches, lozenges, and gum; and other kinds and forms of nicotine prepared in such manner as to be suitable for chewing or smoking in a pipe or otherwise, or both for chewing and smoking or for inhalation, absorption, or ingesting by any other means.

In addition, beginning on July 1, 2025, “tobacco products” does not include any product that has been approved by the United States Food and Drug Administration for sale as a tobacco or smoking cessation product, a nicotine replacement therapy product, or for other medical purposes where that product is marketed and sold solely for such approved use, including but not limited to spray or inhaler prescribed by a physician, chewing gum, skin patches, or lozenges.

The tobacco products tax is imposed upon the last distributor who sells tobacco products to a retailer or consumer located in Illinois.

Note: For help determining which return to file for little cigars, see the cigarette tax and cigarette use tax forms webpage. Little cigar means and includes any roll, made wholly or in part of tobacco, where such roll has an integrated cellulose acetate filter and weighs less than 4 pounds per thousand and the wrapper or cover of which is made in whole or in part of tobacco.

Wholesale Price

Wholesale price means the total invoice price at which tobacco products are sold by a distributor before the allowance of any discounts, trade allowance, rebates, or other reductions for all products sold or otherwise disposed of during the filing period. Surcharges added by distributors are considered part of the wholesale price subject to tax.

Instructions

Schedule Code

There are two types of schedules for tobacco product transactions.

- Schedule of Receipts provides detail to support all tobacco products received (purchased).

- Schedule of Disbursements provides detail to support all tobacco products disposed (sold).

The list of Schedule Codes is:

- 1A – Tobacco Products received from manufacturer or first importer

- 1B – Tobacco Products received from a person other than a manufacturer or first importer (e.g., wholesaler, distributor, or other licensee)

- 1C – Tobacco Products received from a retailer or end user

- 1D – Tobacco Products received by manufacturer or first importer from a person other than a manufacturer or first importer

- 2A – Tobacco Products disposed by a manufacturer or first importer

- 2B – Tobacco Products disposed to a person other than a manufacturer or first importer (e.g., wholesaler, distributor, or other licensee)

- 2C – Tobacco Products disposed to a retailer or end user

- 2D – Tobacco Products returned to the manufacturer

Document Date

Enter the date as provided on the vendor/customer invoice.

Document Type

Enter Invoice. This field will not display in MyTax Illinois.

Document Number

Enter the invoice number as provided.

Customer Type

Enter the appropriate code for the type of customer.

The list of Customer Types by Schedule Code is:

1A

|

1B

|

1C

|

1D

|

2A

|

2B

|

2C

|

2D

|

Customer Name

Enter the name of the entity purchased from, sold to, or shipped/billed to depending on the type of transaction being reported. Report the entity as invoiced. Invoices are to show the name(s) and address(es) of permittees as permitted or licensed (legal name, “doing business as” name (DBA), and street address).

Customer Street Address

Enter the physical address of the entity purchased from, sold to, or shipped/billed to depending on the type of transaction being reported. Do not enter Post Office box information.

Customer City

Enter the city of the entity purchased from, sold to, or shipped/billed to depending on the type of transaction being reported.

Customer State

Enter the state of the entity purchased from, sold to, or shipped/billed to depending on the type of transaction being reported.

Customer Country

Enter the two-character country code of the entity purchased from, sold to, or shipped/billed to depending on the type of transaction being reported. Valid country codes can be found at https://www.irs.gov/e-file-providers/country-codes.

Customer Zip

Enter the zip code of the entity purchased from, sold to, or shipped/billed to depending on the type of transaction being reported.

Customer FEIN

Enter the Federal Employer Identification Number (FEIN). The FEIN is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to business entities operating in the United States for the purposes of identification.

Customer ID

Enter the entity’s valid and active license number issued by the Illinois Department of Revenue using the format below:

- Tobacco Products Distributors are assigned a TP license (TP-#####)

- Cigarette and Tobacco Products Retailers are assigned a CT license (CT-#####)

- Tobacco Products Retailers are assigned a CT license (CT-#####)

Federal Description

Enter the type of tobacco product based on the federal definition.

The list of Federal Descriptions is:

- Chewing Tobacco

- Large Cigar

- Pipe Tobacco

- Roll Your Own

- Small Cigar (Cigars weighing not more than three pounds per thousand but not defined as Little Cigars at the bottom of Page 1 above)

- Snuff

- Alternative Nicotine Product

- E-liquid Product

- Vapor Product

- Other

State Description

Enter the type of tobacco product based on the State’s statutes and regulations.

The list of State Descriptions is:

- IL-OTP – Tobacco Products excluding Moist Snuff and E-cigarettes

- IL-MS – Moist Snuff

- IL-ECIG – E-cigarettes

MSA Status

Select the appropriate code for the MSA status of the manufacturer.

The list of MSA Statuses is:

- OPM – Original Participating Manufacturer

- NPM – Non-Participating Manufacturer

- SPM – Subsequent Participating Manufacturer

- N/A – Not Applicable

- PM – Participating Manufacturer

- NPM1 – Non-Participating Manufacturer 1

- NPM2 – Non-Participating Manufacturer 2

- NSM - Texas

Price

Enter the sales price of the tobacco product. This field only applies to delivery sellers. (Not applicable in Illinois at this time.)

Tax Jurisdiction

Enter the applicable tax jurisdiction code. Refer to the TUP-750 Implementation Guide, Table 5 – Tax Jurisdiction Code List.

UPC Number

Enter the Universal Product Code (UPC) assigned to the product brand you are reporting.

UPCs Unit of Measure (UPCs UOM)

Select the appropriate code for the UOM of the UPC being reported.

The list of UPCs Unit of Measures is:

- PAK – Pack

- STK – Stick

- BOX – Box

- ECH – “Eaches” (each defined unit of taxable product)

- BAG – Bag

- TIN – Tin (Beginning July 1, 2025, this includes any product that is made from or derived from tobacco, or that contains nicotine whether natural or synthetic that is intended for human consumption or is likely to be consumed, including but not limited to nicotine pouches, lozenges, and gum.)

- FOI – Foil

- CAN – Can

- BUL – Bulk

- TUB – Tub

- PCH – Pouch

- BUN – Bundle

- PLG – Plug

- CUT – Cut

- BOT – Bottle

- JAR – Jar

- OTH – Other

Product Description

Enter a narrative description of the product being reported. This information is typically taken from the line item on the invoice.

Manufacturer

Enter the name of the entity manufacturing the product being reported.

Manufacturer EIN

Enter the Employer Identification Number of the manufacturer of the tobacco product being reported.

Brand Family

Enter the brand family for the product being reported. This should agree with the UPC identified in the UPC number field.

Unit

Enter the lowest number of consumable units in the retail package being reported.

Unit Description

Enter the appropriate unit description code. A unit is the smallest consumable container size.

The list of Unit Descriptions is:

- PAK – Pack

- STK – Stick

- BOX – Box

- ECH – “Eaches” (each defined unit of taxable product)

- BAG – Bag

- TIN – Tin (Beginning July 1, 2025, this includes any product that is made from or derived from tobacco, or that contains nicotine whether natural or synthetic that is intended for human consumption or is likely to be consumed, including but not limited to nicotine pouches, lozenges, and gum.)

- FOI – Foil

- CAN – Can

- BUL – Bulk

- TUB – Tub

- PCH – Pouch

- BUN – Bundle

- PLG – Plug

- CUT – Cut

- BOT – Bottle

- JAR – Jar

- OTH – Other

Weight/Volume

Enter the total weight or volume of the retail package being reported.

Value

Enter the dollar value for the product being reported. For all tobacco products, effective July 1, 2025, the tax is imposed on the wholesale price.

Quantity

Enter the total number of the retail packages being reported.

Stick Count

If Large Cigar is entered as the Federal Description, multiply the Unit by Quantity.

Extended Taxable Amount

Multiply the Quantity and Value.

The following are not applicable in Illinois at this time.

Delivery Service Name

Enter the name of the delivery service of the transaction being reported.

Delivery Service EIN

Enter the Federal Employer Identification Number (FEIN) of the delivery service. The FEIN is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to business entities operating in the United States for the purposes of identification.

Delivery Service Address

Enter the physical address of the delivery service of the transaction being reported.

Delivery Service City

Enter the city of the delivery service of the transaction being reported.

Delivery Service State

Enter the state of the delivery service of the transaction being reported.

Delivery Service Zip

Enter the zip code of the delivery service of the transaction being reported.

Delivery Service Phone Number

Enter the phone number of the delivery service of the transaction being reported.

Setting up a CSV File

The CSV (Comma Separated Value) file format is used for importing the tobacco products schedules file directly to an Illinois Form TP-1-IL. The import feature is recommended for users who have software that can create the CSV format. Using a spreadsheet program (e.g., Excel), columns are required to create a CSV file that is recognized and accepted by MyTax Illinois. You may also use a text file following the same formatting. The file should have no header row.

Note: Due to the new layout of Form TP-1 and its Transaction Schedule, there will be a maximum file limit (based on size of CSV formatted file). If your return and schedules exceed 50MB, you will be required to file using the direct file method. As we monitor performance of the system with the new layouts, this maximum file limit may be reduced in order to provide the best taxpayer experience and to consider system resources.

Large data table content is loading...

| Column | Field Name | Max Length | Data Type | Description |

|---|

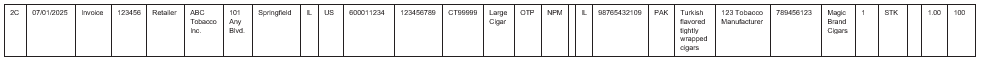

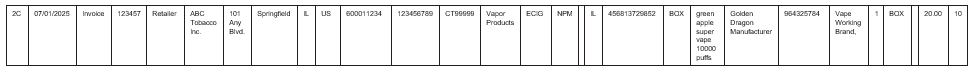

1st Example – Sales to Valid Licensed Tobacco Products Retailer in Illinois:

You are filing TP-1-IL with a sale to an active and valid licensed tobacco products retailer in Illinois, reported with Schedule Code 2C. The invoice number of the shipment is 123456 and the date is 07/01/2025. The retailer’s information is ABC Tobacco, Inc., located at 101 Any Blvd., Springfield, IL 60001-1234, with a FEIN of 12-3456789 and license number CT-99999. The products are listed below:

- 20 packages of Large Cigars manufactured by a Non-Participating Manufacturer, with UPC Number 9 876543210 9, Turkish flavored tightly wrapped cigars, from 123 Tobacco Manufacturer with a FEIN of 78-9456123, Magic Brand Cigars, 5 cigars in a package, with a value of $5.00 per package. The cigars can be sold either individually or in packages of 5 cigars.

- 10 boxes of Vapor Products manufactured by a Non-Participating Manufacturer, with UPC Number 4 5681372985 2, green apple super vape 10000 puffs, from Golden Dragon Manufacturer with a FEIN of 96-4325784, Vape Working Brand, 1 vape in a box, with a value of $20.00 per box.

- 15 tubs of Moist Snuff manufactured by a not applicable manufacturer, with UPC Number 5 4567892486 3, long-cut mint, from Spit Brothers Manufacturer with a FEIN of 54-6549876, Polar Bear Brand, 10 cans in a tub, with a value of $12.00 per tub.

The record for the transaction would be reported as follows:

Text File Example (e.g., Notepad)

Note: The example below shows each line returned due to the margins of the written instructions, but the text file must be written as one continuous line for each entry with fields separated by commas and a hard return used to signify the next entry. Using the example, the file would show a total of 3 separate lines, with one for each of the product transactions.

- 2C,07/01/2025,Invoice,123456,Retailer,ABCTobacco Inc.,101 Any Blvd.,Springfield,IL,US,600011234,123456789,CT99999,Large Cigar,OTP, NPM,,IL,98765432109,PAK,Turkish flavored tightly wrapped cigars,123 Tobacco Manufacturer,789456123,Magic Brand Cigars,1,STK,,1.00,100

- 2C,07/01/2025,Invoice,123456,Retailer,ABC Tobacco Inc.,101 Any Blvd.,Springfield,IL,US,600011234,123456789,CT99999,Vapor Products,ECIG, NPM,,IL,456813729852,BOX,green apple super vape 10000 puffs,Golden Dragon Manufacturer,964325784,Vape Working Brand,1,BOX,,20.00,10

- 2C,07/01/2025,Invoice,123456,Retailer,ABC Tobacco Inc.,101 Any Blvd.,Springfield,IL,US,600011234,123456789,CT99999,Snuff,MS, N/A,,IL,545678924863,TUB,long-cut mint,Spit Brothers Manufacturer,546549876,Polar Bear Brand,1,CAN,,1.2,150

CSV Spreadsheet Example (e.g., Excel)

- 20 packages of Large Cigars manufactured by a Non-Participating Manufacturer, with UPC Number 9 876543210 9, Turkish flavored tightly wrapped cigars, from 123 Tobacco Manufacturer with a FEIN of 78-9456123, Magic Brand Cigars, 5 cigars in a package, with a value of $5.00 per package. The cigars can be sold either individually or in packages of 5 cigars.

- 10 boxes of Vapor Products manufactured by a Non-Participating Manufacturer, with UPC Number 4 5681372985 2, green apple super vape 10000 puffs, from Golden Dragon Manufacturer with a FEIN of 96-4325784, Vape Working Brand, 1 vape in a box, with a value of $20.00 per box.

- 15 tubs of Moist Snuff manufactured by a not applicable manufacturer, with UPC Number 5 4567892486 3, long-cut mint, from Spit Brothers Manufacturer with a FEIN of 54-6549876, Polar Bear Brand, 10 cans in a tub, with a value of $12.00 per tub.

Save your spreadsheet or text file using the file type “CSV (Comma delimited) (*.csv)” option. For text files, separate each field with a comma and each record with a hard return. Once you have your file saved in this format, you may use the “Import” option in MyTax Illinois.

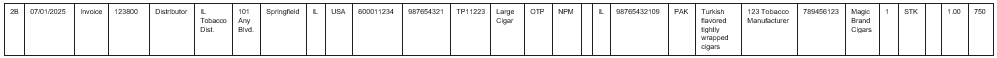

2nd Example – Sales to Valid Tobacco Products Distributors in Illinois.

You are filing TP-1-IL with a sale to an active and valid licensed tobacco products distributor in Illinois, reported with Schedule Code 2B. The invoice number of the shipment is 123800 and the date is 07/01/2025. The distributor’s information is IL Tobacco Dist., located at 101 Any Blvd., Springfield, IL 60001-1234, with a FEIN of 98-7654321 and a license number TP-11223. The products are listed below:

- 150 packages of Large Cigars manufactured by a Non-Participating Manufacturer, with UPC Number 9 876543210 9, Turkish flavored tightly wrapped cigars, from 123 Tobacco Manufacturer with a FEIN of 78-9456123, Magic Brand Cigars, 5 cigars in a package, with a value of $5.00 per package. The cigars can be sold either individually or in packages of 5 cigars.

The record for the transaction would be reported as follows:

Text File Example (e.g., Notepad)

Note: The example below shows each line returned due to the margins of the written instructions, but the text file must be written as one continuous line for each entry with fields separated by commas and a hard return used to signify the next entry. Using the example, the file would show a total of 1 line for the product transaction.

- 2B,07/01/2025,Invoice,123800,Distributor,IL Tobacco Dist.,101 Any Blvd.,Springfield,IL,US,600011234,987654321,TP11223,Large Cigar,OTP,NP- M,,IL,98765432109,PAK,Turkish flavored tightly wrapped cigars,123 Tobacco Manufacturer,789456123,Magic Brand Cigars,1,STK,,1.00,750

CSV Spreadsheet Example (e.g., Excel)

- 150 packages of Large Cigars manufactured by a Non-Participating Manufacturer, with UPC Number 9 876543210 9,Turkish flavored tightly wrapped cigars, from 123 Tobacco Manufacturer with a FEIN of 78-9456123, Magic Brand Cigars, 5 cigars in a package, with a value of $5.00 per package. The cigars can be sold either individually or in packages of 5 cigars.

TP-1 Instructions (R-07/25) | Printed by authority of the State of Illinois — Electronic only, one copy